In The Great Tax Debate, Jason Furman & Lawrence H. Summers take on Robert Barro, who makes his case in a separate PS On Point, linked below.

CAMBRIDGE – The United States House of Representatives and Senate have each passed tax cuts that would reduce the corporate rate from 35% to 20%, allow businesses to write off equipment and structures more quickly, and make numerous other changes to business and personal taxation. The official estimates of the bills, carried out by the Republican-appointed Joint Committee on Taxation (JCT), conclude that the bills would raise the long-run level of output by less than 1% – resulting in a growth boost of about 0.1 percentage point annually in the first decade. Several other analyses using established models have found similarly modest growth effects.

Our Harvard colleague and friend Robert Barro disagrees. He recently co-signed a letter with eight other conservative economists finding that the tax cuts would raise the long-run level of output by 3%. The letter also asserted that “the gain in the long-run level of GDP would be just over 3%, or 0.3% per year for a decade,” an estimate that the US Treasury Department has been pointing to justify its claim that dynamic feedback covers much of the cost of the tax cuts.

In response to our listing of numerous flaws in this letter, including its serious misuse of the academic literature, the authors backed off the claim that the annual growth rate would rise by 0.3 percentage point and failed to defend many of the other assumptions as well. Notably, the then-chief economist of the Organization for Economic Cooperation and Development weighed in to support our view that the authors had misused an OECD study, one of only three studies they cited to reach their conclusions.

Now Barro has provided Project Syndicate with an analysis that uses his own estimates to conclude that the long-run level of output would increase by 7%. He maintains that, assuming the economy converges to its long-run steady state at 5% per year, this would mean an additional 0.3-percentage-point increase in the annual growth rate.

But even at Barro’s growth rate, the dynamic feedback would not pay for the tax cut. (Under his convergence assumptions, the 3% increase in output in his previous group letter would translate into a 0.1-percentage-point increase in the annual growth rate over the next decade. As we argued in our response to that letter, this is also consistent with the annual growth rates implied by the papers Barro and his co-signers cited.)

Flawed Implementation of a Sensible Model

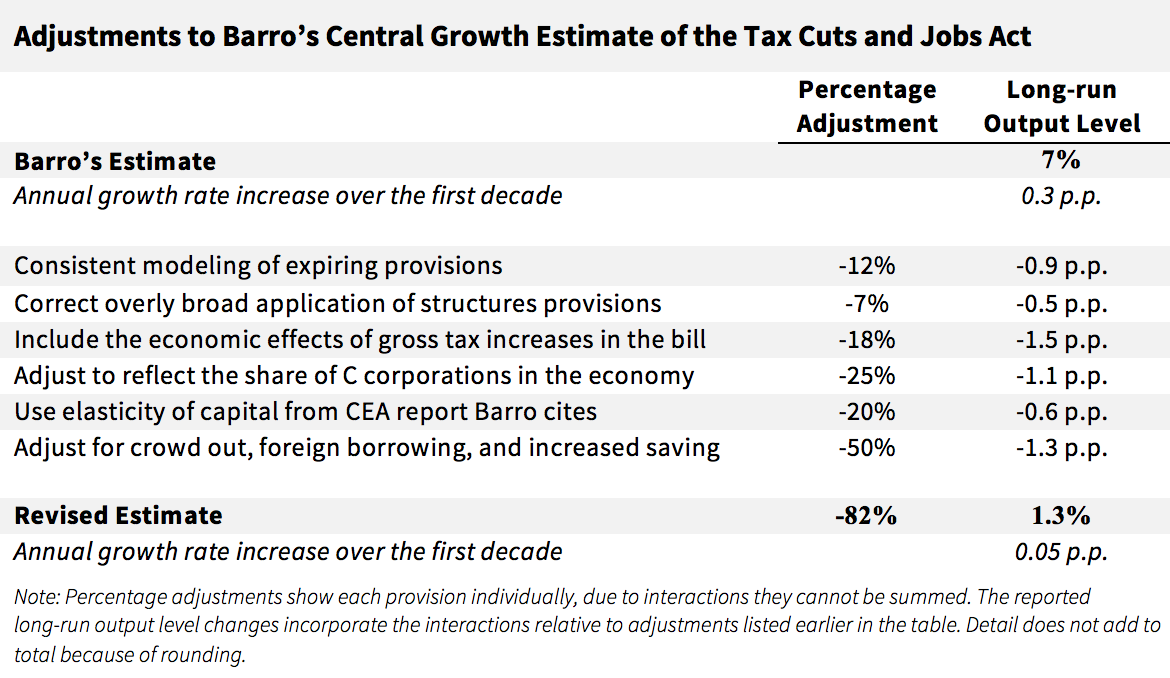

We welcome Barro’s explicit calculation and believe in the utility of the type of framework he uses. Unfortunately, he makes errors in modeling the actual tax provisions and in choosing parameters that distort his conclusions substantially upward. Based on our adjustments to his calculations, we believe that Barro’s method, correctly applied, would yield an increase in the level of long-run GDP of about 1%. This works out to a 0.05-percentage-point increase in the annual growth rate, following Barro’s convergence assumption. The fact that this conclusion is similar to the JCT estimate should not be a surprise, because the JCT already incorporates most of the economic relationships that Barro is modeling, but correctly models the actual tax provisions and appropriate economic parameters.

The table below summarizes the adjustments we made to Barro’s numbers, recognizing that a number of them are – like his own estimates – based on plausible guesses, not hard data. A number of other adjustments could be made, most of which would likely lower his estimate still further.

Modeling the Tax Plan

The first key problem with Barro’s analysis is that it makes the least favorable assumptions about current law and the most favorable assumptions about future policy. Since 2007, businesses have been able to write off at least 50% of the cost of their investment in equipment immediately, although this benefit is scheduled to expire. Under the House and Senate bills, businesses would be able to write off 100% of their spending on fixed investment immediately for the next five years.

Strangely, Barro assumes not only that, absent the legislation, the 50% bonus depreciation would expire, but also that the proposed 100% bonus depreciation, which is temporary in the tax bills, would be maintained indefinitely. But one should assume either that both are permanent, or that neither is. In either case, the user cost of capital for equipment would fall by 6%, not the 12% estimated by Barro. Using the share of equipment in total capital, this would reduce Barro’s user-cost reduction and corresponding growth estimates by 12%.

The second problem with Barro’s analysis is that it mistakenly models the accelerated depreciation of structures, including by assuming that it applies to all structures. The Senate bill included a provision that would accelerate the depreciation of some structures from 39 years to 25 years. Barro estimates that this provision alone, which costs 0.01% of GDP in the tenth year, would boost output by 1.3% – an extraordinary multiplier of more than 100.

This astonishing figure partly reflects Barro’s failure to account for the fact that, while the accelerated-depreciation provision applies to many types of structures (for example, office buildings and hospitals), many other types of structures already benefit from substantially more accelerated depreciation. As a result, restaurants, most energy facilities, mining facilities, farms, water supplies, and amusement parks, for example, would not qualify for this provision. In addition, much of such investment in structures is heavily leveraged, implying that it already has a very low effective tax rate. A conservative application of all of these adjustments would reduce the portion of Barro’s structures estimate due to accelerated cost recovery by three-quarters, reducing his overall growth estimate by 7%, after taking into account interactions with the rate reduction.

We would also argue – but do not incorporate in these adjustments – that future depreciation allowances are like a bond and should be discounted at a lower rate. Making this adjustment would lower the marginal tax rate under current law and thus attenuate much of the marginal rate reduction attributed to the legislation. This adjustment would apply to both equipment and especially to structures.

Third, Barro assumes a growth boost from the gross tax cuts in the bill, but disregards the gross tax increases. As noted above, one provision alone, costing 0.01% of GDP, is assumed to boost the level of output by 1%. But Barro’s analysis ignores provisions such as one that reduces Net Operating Loss Carrybacks, another that eliminates businesses’ ability to expense research and development costs, and yet another that rescinds a tax deduction for manufacturing. Together with other provisions, these changes, according to the JCT, amount to 0.5% of GDP.

In economic terms, Barro is treating these as lump-sum taxes that do not affect behavior. In fact, they would raise marginal tax rates on R&D, risk taking, and manufacturing (relative to the estimates Barro is using). Very conservatively assuming that these provisions are modeled as being half as impactful, dollar for dollar, as the statutory rate reduction, this would offset 18% of Barro’s growth estimate.

Fourth, with respect to the capital stock, Barro assumes that C-corporations account for the large majority, especially the long-lived capital stock. Although we lack our own estimates, we believe that his figure is too high for three reasons. First, C-corporations account for only about 40% of total business income. Second, C-corporations tend to have shorter-lived assets than pass-through corporations, meaning that they would benefit less from these tax changes. And, third, because smaller businesses already benefit from expensing provisions, they would not benefit from accelerated depreciation. All told, we would guess that the corporate sector is half as large as Barro’s estimate, but, erring once again on the side of conservatism, we reduce his estimate by only 25%.

A fifth problem with Barro’s assessment is that, unlike other analyses of the impact of the proposed tax changes, it uses parameters that are higher than the literature it cites. He assumes that the elasticity of capital with respect to the user cost is 1.25 – that is to say, a reduction of the user cost of capital translates into a percentage increase in the capital stock that is 1.25 times larger.

Barro justifies this estimate by pointing to a recent literature survey by the Council of Economic Advisers. But the CEA cited nine estimates, eight of which were below 1.25 (the ninth was for a small open economy). According to the CEA, “The emerging consensus in the academic literature places the user-cost elasticity of investment at -1.0.” Using what the CEA describes as the “emerging consensus” would lower Barro’s estimates by 20%.

The final key problem is that Barro assumes that the stock of equipment and structures increases by 15%, or about $3 trillion, but ignores the fact that the additional capital has to come from somewhere – from other sectors, from abroad, or from consumption. If it comes from foreigners, as would follow from the assumption that the United States is a small open economy, then we would need to repay those foreigners a return on their investment. This return would be subtracted from gross national product (GNP), or national income. If the funding comes from domestic sources, it could be diverted from other sectors that do not experience the same reduction in capital taxation, like housing. The economy might still benefit from more corporate investment and less residential investment, but estimates that include the former but ignore the later greatly overstate the total impact.

Taking all of these adjustments into account, we believe a reasonable analysis would reduce Barro’s estimate of the tax bill’s impact on US growth by half. His growth estimates would be unchanged if the additional financing for capital accumulation came from reduced consumption; but that would mean that people’s wellbeing increased more slowly than the size of the economy.

Other Objections

These adjustments do not encompass all of the doubts we have about Barro’s analysis. In particular, we accept his translation of the capital stock into additional growth, even though it appears to be implausibly high (perhaps by a factor of two or more). For perspective, Barro estimates that the long-run stock of equipment and structures increases by 18.75%. In 2016, the total stock of equipment and structures was $20 trillion, or 107% of GDP. He thus is assuming that an increase in equipment and structures totaling 20 percentage points of GDP (18.75% multiplied by 1.07) could produce 7% more output per year. That is a remarkable 35% return, even before adjusting for the limited size of the C-corporation sector or many of the other issues we discuss above.

Another, broader shortcoming of Barro’s analysis is that it focuses entirely on the business side of the congressional tax bill. The JCT estimated a modest increase in the level of output over the next decade associated with the individual provisions. This estimate could be added to Barro’s total for a complete assessment of the impact of the proposed tax changes on growth.

On the other hand, Barro’s analysis does not reflect the negative economic effects implied by higher budget deficits, increased sheltering, marginal tax rates for some pass-through businesses in excess of 100%, and new sources of complexity. All told, our own judgment is that when all of these effects are factored in, long-run GNP would more plausibly decline, not grow, if the tax bill is enacted and its major provisions are made permanent.

We agree with Barro’s suggestion that the ten-year impact of a corporate tax change is between one-third and one-half of its long-run impact. So, even if our estimates are too low by a factor of 2-3, the impact of the legislation is in the range of what the JCT estimated.

A Better Approach

Barro is a serious and careful economist. The fact that his estimates are nearly an order of magnitude off is a reflection of how difficult it is for any single economist, no matter how smart, to use the back of an envelope to estimate the effects of extremely complicated legislation. We do not recommend that anyone use our amendments of Barro’s numbers. After all, our estimates contain many guesses and simplifications that are no substitute for a complete analysis. We offer them in support of our larger point: We should generally rely on the estimates of the official scorekeepers, who already take into account all of the user-cost effects that Barro incorporates in his analysis, but who also correctly apply those effects to the relevant economic sectors and carefully model their interactions with other parts of the tax bill.

Instead of being used to justify this tax bill, Barro’s insights could have helped to shape a much better tax bill. Such a bill would include permanent instead of temporary expensing, apply expensing to structures as well as equipment, and reduce the statutory tax rate by a smaller margin.

CAMBRIDGE – The United States House of Representatives and Senate have each passed tax cuts that would reduce the corporate rate from 35% to 20%, allow businesses to write off equipment and structures more quickly, and make numerous other changes to business and personal taxation. The official estimates of the bills, carried out by the Republican-appointed Joint Committee on Taxation (JCT), conclude that the bills would raise the long-run level of output by less than 1% – resulting in a growth boost of about 0.1 percentage point annually in the first decade. Several other analyses using established models have found similarly modest growth effects.

Our Harvard colleague and friend Robert Barro disagrees. He recently co-signed a letter with eight other conservative economists finding that the tax cuts would raise the long-run level of output by 3%. The letter also asserted that “the gain in the long-run level of GDP would be just over 3%, or 0.3% per year for a decade,” an estimate that the US Treasury Department has been pointing to justify its claim that dynamic feedback covers much of the cost of the tax cuts.

In response to our listing of numerous flaws in this letter, including its serious misuse of the academic literature, the authors backed off the claim that the annual growth rate would rise by 0.3 percentage point and failed to defend many of the other assumptions as well. Notably, the then-chief economist of the Organization for Economic Cooperation and Development weighed in to support our view that the authors had misused an OECD study, one of only three studies they cited to reach their conclusions.

Now Barro has provided Project Syndicate with an analysis that uses his own estimates to conclude that the long-run level of output would increase by 7%. He maintains that, assuming the economy converges to its long-run steady state at 5% per year, this would mean an additional 0.3-percentage-point increase in the annual growth rate.

But even at Barro’s growth rate, the dynamic feedback would not pay for the tax cut. (Under his convergence assumptions, the 3% increase in output in his previous group letter would translate into a 0.1-percentage-point increase in the annual growth rate over the next decade. As we argued in our response to that letter, this is also consistent with the annual growth rates implied by the papers Barro and his co-signers cited.)

Flawed Implementation of a Sensible Model

We welcome Barro’s explicit calculation and believe in the utility of the type of framework he uses. Unfortunately, he makes errors in modeling the actual tax provisions and in choosing parameters that distort his conclusions substantially upward. Based on our adjustments to his calculations, we believe that Barro’s method, correctly applied, would yield an increase in the level of long-run GDP of about 1%. This works out to a 0.05-percentage-point increase in the annual growth rate, following Barro’s convergence assumption. The fact that this conclusion is similar to the JCT estimate should not be a surprise, because the JCT already incorporates most of the economic relationships that Barro is modeling, but correctly models the actual tax provisions and appropriate economic parameters.

The table below summarizes the adjustments we made to Barro’s numbers, recognizing that a number of them are – like his own estimates – based on plausible guesses, not hard data. A number of other adjustments could be made, most of which would likely lower his estimate still further.

Modeling the Tax Plan

The first key problem with Barro’s analysis is that it makes the least favorable assumptions about current law and the most favorable assumptions about future policy. Since 2007, businesses have been able to write off at least 50% of the cost of their investment in equipment immediately, although this benefit is scheduled to expire. Under the House and Senate bills, businesses would be able to write off 100% of their spending on fixed investment immediately for the next five years.

Strangely, Barro assumes not only that, absent the legislation, the 50% bonus depreciation would expire, but also that the proposed 100% bonus depreciation, which is temporary in the tax bills, would be maintained indefinitely. But one should assume either that both are permanent, or that neither is. In either case, the user cost of capital for equipment would fall by 6%, not the 12% estimated by Barro. Using the share of equipment in total capital, this would reduce Barro’s user-cost reduction and corresponding growth estimates by 12%.

BLACK FRIDAY SALE: Subscribe for as little as $34.99

Subscribe now to gain access to insights and analyses from the world’s leading thinkers – starting at just $34.99 for your first year.

Subscribe Now

The second problem with Barro’s analysis is that it mistakenly models the accelerated depreciation of structures, including by assuming that it applies to all structures. The Senate bill included a provision that would accelerate the depreciation of some structures from 39 years to 25 years. Barro estimates that this provision alone, which costs 0.01% of GDP in the tenth year, would boost output by 1.3% – an extraordinary multiplier of more than 100.

This astonishing figure partly reflects Barro’s failure to account for the fact that, while the accelerated-depreciation provision applies to many types of structures (for example, office buildings and hospitals), many other types of structures already benefit from substantially more accelerated depreciation. As a result, restaurants, most energy facilities, mining facilities, farms, water supplies, and amusement parks, for example, would not qualify for this provision. In addition, much of such investment in structures is heavily leveraged, implying that it already has a very low effective tax rate. A conservative application of all of these adjustments would reduce the portion of Barro’s structures estimate due to accelerated cost recovery by three-quarters, reducing his overall growth estimate by 7%, after taking into account interactions with the rate reduction.

We would also argue – but do not incorporate in these adjustments – that future depreciation allowances are like a bond and should be discounted at a lower rate. Making this adjustment would lower the marginal tax rate under current law and thus attenuate much of the marginal rate reduction attributed to the legislation. This adjustment would apply to both equipment and especially to structures.

Third, Barro assumes a growth boost from the gross tax cuts in the bill, but disregards the gross tax increases. As noted above, one provision alone, costing 0.01% of GDP, is assumed to boost the level of output by 1%. But Barro’s analysis ignores provisions such as one that reduces Net Operating Loss Carrybacks, another that eliminates businesses’ ability to expense research and development costs, and yet another that rescinds a tax deduction for manufacturing. Together with other provisions, these changes, according to the JCT, amount to 0.5% of GDP.

In economic terms, Barro is treating these as lump-sum taxes that do not affect behavior. In fact, they would raise marginal tax rates on R&D, risk taking, and manufacturing (relative to the estimates Barro is using). Very conservatively assuming that these provisions are modeled as being half as impactful, dollar for dollar, as the statutory rate reduction, this would offset 18% of Barro’s growth estimate.

Fourth, with respect to the capital stock, Barro assumes that C-corporations account for the large majority, especially the long-lived capital stock. Although we lack our own estimates, we believe that his figure is too high for three reasons. First, C-corporations account for only about 40% of total business income. Second, C-corporations tend to have shorter-lived assets than pass-through corporations, meaning that they would benefit less from these tax changes. And, third, because smaller businesses already benefit from expensing provisions, they would not benefit from accelerated depreciation. All told, we would guess that the corporate sector is half as large as Barro’s estimate, but, erring once again on the side of conservatism, we reduce his estimate by only 25%.

A fifth problem with Barro’s assessment is that, unlike other analyses of the impact of the proposed tax changes, it uses parameters that are higher than the literature it cites. He assumes that the elasticity of capital with respect to the user cost is 1.25 – that is to say, a reduction of the user cost of capital translates into a percentage increase in the capital stock that is 1.25 times larger.

Barro justifies this estimate by pointing to a recent literature survey by the Council of Economic Advisers. But the CEA cited nine estimates, eight of which were below 1.25 (the ninth was for a small open economy). According to the CEA, “The emerging consensus in the academic literature places the user-cost elasticity of investment at -1.0.” Using what the CEA describes as the “emerging consensus” would lower Barro’s estimates by 20%.

The final key problem is that Barro assumes that the stock of equipment and structures increases by 15%, or about $3 trillion, but ignores the fact that the additional capital has to come from somewhere – from other sectors, from abroad, or from consumption. If it comes from foreigners, as would follow from the assumption that the United States is a small open economy, then we would need to repay those foreigners a return on their investment. This return would be subtracted from gross national product (GNP), or national income. If the funding comes from domestic sources, it could be diverted from other sectors that do not experience the same reduction in capital taxation, like housing. The economy might still benefit from more corporate investment and less residential investment, but estimates that include the former but ignore the later greatly overstate the total impact.

Taking all of these adjustments into account, we believe a reasonable analysis would reduce Barro’s estimate of the tax bill’s impact on US growth by half. His growth estimates would be unchanged if the additional financing for capital accumulation came from reduced consumption; but that would mean that people’s wellbeing increased more slowly than the size of the economy.

Other Objections

These adjustments do not encompass all of the doubts we have about Barro’s analysis. In particular, we accept his translation of the capital stock into additional growth, even though it appears to be implausibly high (perhaps by a factor of two or more). For perspective, Barro estimates that the long-run stock of equipment and structures increases by 18.75%. In 2016, the total stock of equipment and structures was $20 trillion, or 107% of GDP. He thus is assuming that an increase in equipment and structures totaling 20 percentage points of GDP (18.75% multiplied by 1.07) could produce 7% more output per year. That is a remarkable 35% return, even before adjusting for the limited size of the C-corporation sector or many of the other issues we discuss above.

Another, broader shortcoming of Barro’s analysis is that it focuses entirely on the business side of the congressional tax bill. The JCT estimated a modest increase in the level of output over the next decade associated with the individual provisions. This estimate could be added to Barro’s total for a complete assessment of the impact of the proposed tax changes on growth.

On the other hand, Barro’s analysis does not reflect the negative economic effects implied by higher budget deficits, increased sheltering, marginal tax rates for some pass-through businesses in excess of 100%, and new sources of complexity. All told, our own judgment is that when all of these effects are factored in, long-run GNP would more plausibly decline, not grow, if the tax bill is enacted and its major provisions are made permanent.

We agree with Barro’s suggestion that the ten-year impact of a corporate tax change is between one-third and one-half of its long-run impact. So, even if our estimates are too low by a factor of 2-3, the impact of the legislation is in the range of what the JCT estimated.

A Better Approach

Barro is a serious and careful economist. The fact that his estimates are nearly an order of magnitude off is a reflection of how difficult it is for any single economist, no matter how smart, to use the back of an envelope to estimate the effects of extremely complicated legislation. We do not recommend that anyone use our amendments of Barro’s numbers. After all, our estimates contain many guesses and simplifications that are no substitute for a complete analysis. We offer them in support of our larger point: We should generally rely on the estimates of the official scorekeepers, who already take into account all of the user-cost effects that Barro incorporates in his analysis, but who also correctly apply those effects to the relevant economic sectors and carefully model their interactions with other parts of the tax bill.

Instead of being used to justify this tax bill, Barro’s insights could have helped to shape a much better tax bill. Such a bill would include permanent instead of temporary expensing, apply expensing to structures as well as equipment, and reduce the statutory tax rate by a smaller margin.