Trump’s Self-Fulfilling Crisis

True of people and events. Maybe not so with tough verdicts in the markets.

Stephen S. Roach, a faculty member at Yale University and former chairman of Morgan Stanley Asia, is the author of Unbalanced: The Codependency of America and China (Yale University Press, 2014) and Accidental Conflict: America, China, and the Clash of False Narratives (Yale University Press, 2022).

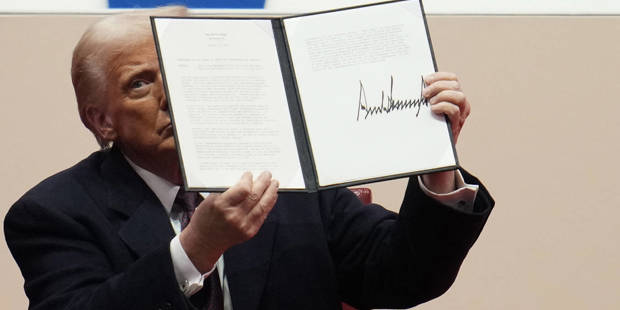

Mar 25, 2025 Stephen S. Roach likens Donald Trump’s reversal of America’s global leadership role to a full-blown crisis, similar to COVID-19.

Feb 28, 2025 Stephen S. Roach shows how the US president’s policies could create the very problems he falsely claims to be confronting.

Jan 24, 2025 Stephen S. Roach points out that the new “External Revenue Service” would target domestic importers, not foreign producers.

Dec 19, 2024 Stephen S. Roach wonders whether the country’s political system is at odds with the values underpinning affluent societies.

Nov 26, 2024 Stephen S. Roach warns of misguided optimism about the state of China’s economy and Donald Trump’s tariff agenda.