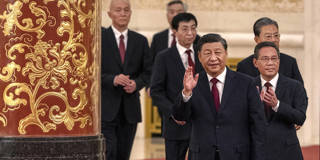

Investors seem convinced that Chinese President Xi Jinping’s new leadership lacks the knowhow and independence to mount an effective response to the profound economic challenges the country faces. Whether they are proved right or wrong depends – like virtually everything else in China nowadays – on the man at the top.

ATHENS – The new leadership team selected by Chinese President Xi Jinping at the 20th National Congress of the Communist Party of China failed to impress financial markets at home and abroad. In the week following the announcement of Xi’s new team, Hong Kong’s stock market declined by 8.3%, and the Shanghai Composite Index, China’s largest stock exchange, dropped 4%, despite the Chinese government’s intervention to prop up prices. US-listed Chinese stocks plunged by 15%.

ATHENS – The new leadership team selected by Chinese President Xi Jinping at the 20th National Congress of the Communist Party of China failed to impress financial markets at home and abroad. In the week following the announcement of Xi’s new team, Hong Kong’s stock market declined by 8.3%, and the Shanghai Composite Index, China’s largest stock exchange, dropped 4%, despite the Chinese government’s intervention to prop up prices. US-listed Chinese stocks plunged by 15%.